Compliance. Clarity. Cashflow. Powered by AI.

CaesarTax & ComplianceAI

Modern Risk Management - Smarter Compliance. Stronger Margins

Payment, Tax & Compliance Solutions

Automating Tax Clarity & Compliance for Growing Businesses

Core Problem Solved

Small and medium-sized businesses often:

- Misreport under the wrong TPT classification codes (e.g., 017, 162).

- Miss reporting deadlines or thresholds for state/local tax remittances.

- Lack guidance on deductions, exemptions, or audit readiness.

- Struggle with multi-jurisdiction sales taxes.

Learn more:

- Generative AI Solution Components

- Integration Capabilities

- Dashboards & Reporting

- Compliance & Security

- Use Cases

- Product Tiers

CaesarTax Generative AI Solution Components

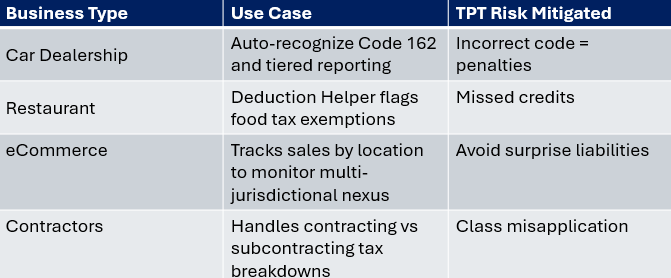

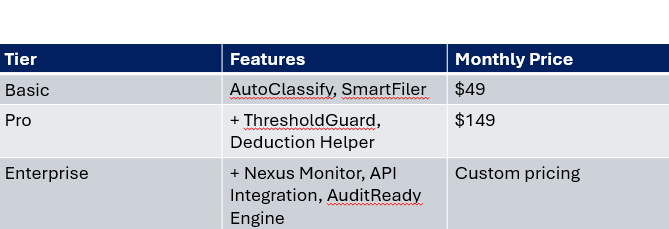

AutoClassify AI

- Uses NLP + machine learning to classify business activities under correct Arizona TPT codes (e.g., 017 for retail, 162 for vehicle sales).

- Learns from tax law changes and historical filings.

- Offers guidance if multiple codes apply (e.g., hybrid businesses).

SmartFiler GPT

- Auto-generates TPT reports (monthly, quarterly, annual).

- Custom prompts: “Create my May 2025 TPT report with deductions for goods sold under resale license.”

- Handles partial-year business activity and threshold compliance.

ThresholdGuard

- Real-time tracking of taxable income thresholds across all city and county layers in Arizona.

- Alerts when nearing Tier 1 / Tier 2 filing breakpoints (e.g., for retail sales thresholds in certain jurisdictions).

Deduction Helper

- Suggests potential deductions based on uploaded receipts, invoices, and transaction history.

- Includes resale, out-of-state sales, subcontracting exemptions, etc.

AuditReady Engine

- Prepares audit checklists and organizes digital receipts, proof of exemption, and returns.

- Simulates potential audit risk scores using AI analysis.

Multi-State Nexus Monitor (Optional Add-On)

- Tracks when your business triggers nexus in other states.

- Advises on tax registration or filing obligations outside Arizona.

System Integration Capabilities

Accounting software:

- QuickBooks

- Xero

- NetSuite

ERP:

- Oracle

- NetSuite

- SAP

POS systems:

- Square

- Shopify

- Toast

- Other Booking & POS Systems

CRM platforms:

- Salesforce

- Zoho CRM

- Hubspot

Tax Portals:

- Arizona AZTaxes.gov + APIs to automate uploads or e-filing

Blockchain wallets & payment processors

API-first architecture for real-time data sync across platforms.

Dashboards & Reporting

- Visual real-time tax dashboards

- TPT liability by month/city/county

- Deductions vs revenue trends

- Filing status and alerts

Compliance & Tax Benefits

- Visual real-time tax dashboards

- TPT liability by month/city/county

- Deductions vs revenue trends

- Filing status and alerts

Compliance & Security Security, Governance & Privacy

- AES-256 encrypted data

- SOC 2 Type II compliance for handling sensitive financial info

- Audit trail for all AI-generated filings and interactions

- End-to-end encryption

- Role-based access control (RBAC)

- Immutable audit trail

- GDPR & CCPA compliance

- Configurable retention policies

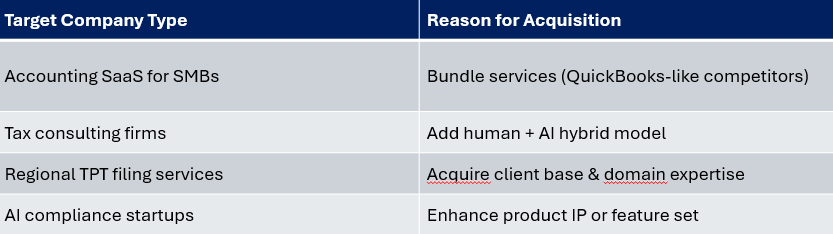

M&A Strategy for CaesarTax AI

Use Cases

Product Tiers

Strategic Acquisition

Target: TPTSmart Inc." – A small Arizona-based SaaS firm offering manual TPT tracking software

Why: They have 1,200 Arizona clients and outdated software with manual filing needs.

Post-Acquisition Synergies:

- Migrate clients to CaesarTax AI platform.

- Upsell clients into Pro or Enterprise tiers.

- Eliminate redundant tools and staff.

- Integrate their city/county TPT database API into CaesarTax AI's engine.

Pro Forma Impact:

+$200K in recurring revenue

$200K

Reduced cost per user by

40%

Customer acquisition cost (CAC) reduced by 25% over 2 years

25%