Compliance. Clarity. Cashflow. Powered by AI.

Industries

Modern Risk Management - Smarter Compliance. Stronger Margins

Payment, Tax & Compliance Solutions

Industries...Trusted Solutions

Finance

Trusted solutions for banks, wealth managers, and fintechs. Automate audit prep, strengthen controls, and meet evolving compliance benchmarks with transparency and speed.

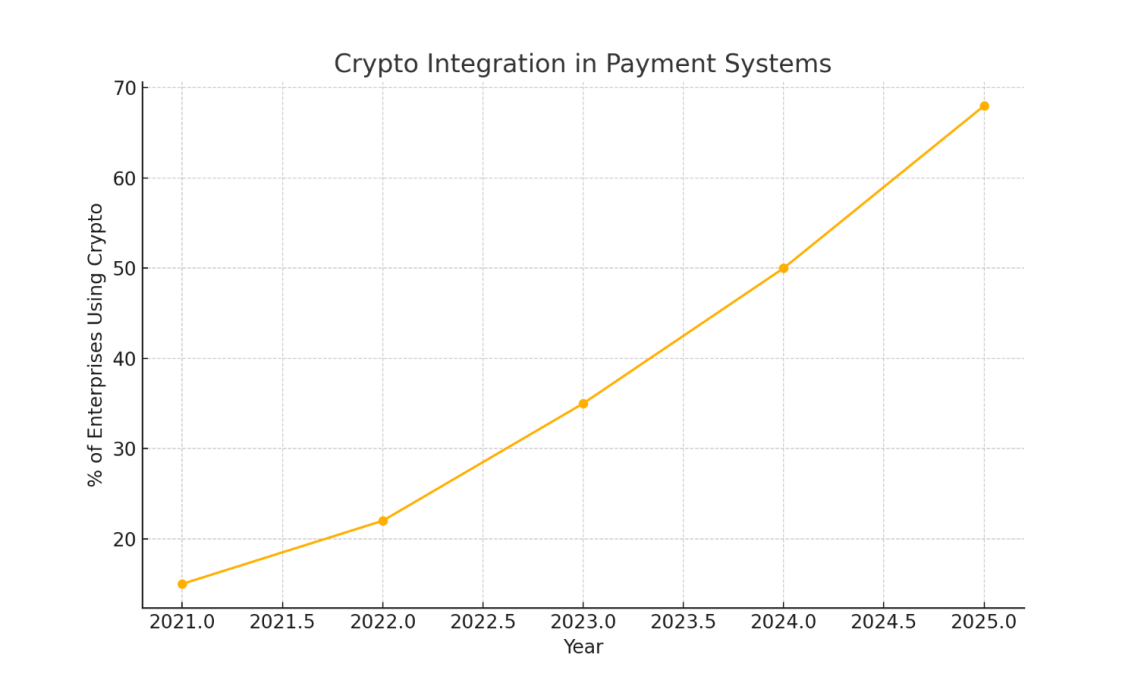

Crypto Exchanges and Wallets

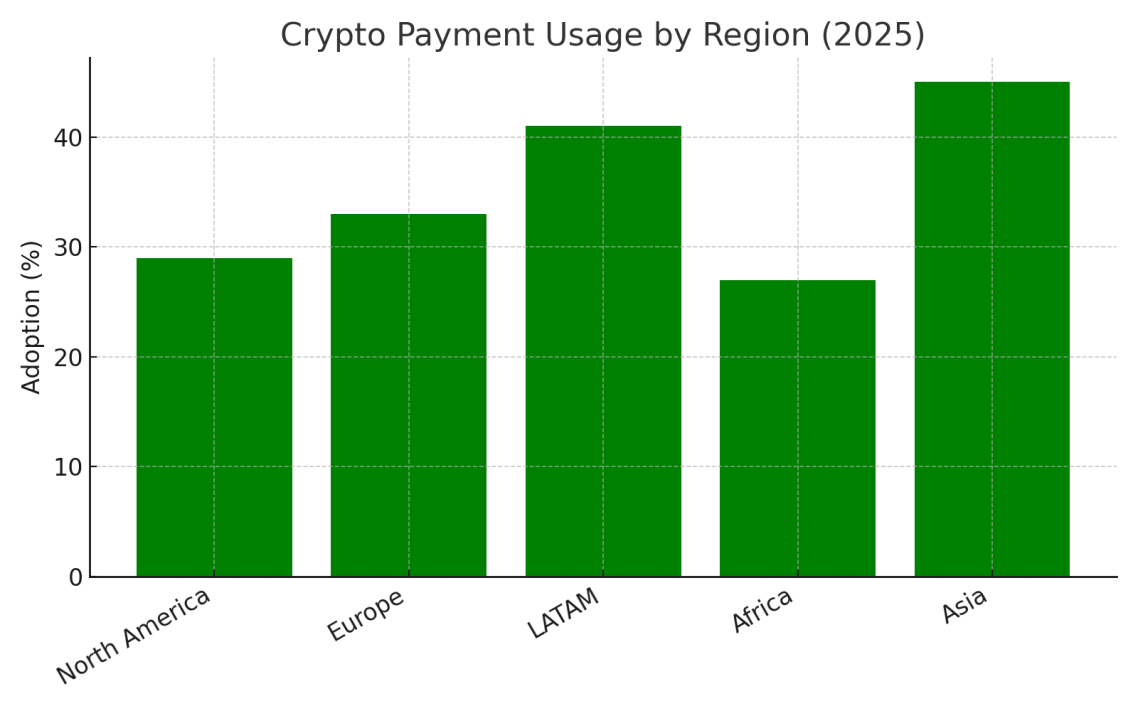

Real-time compliance and wallet KYC tools to help you navigate volatile regulations. Monitor blockchain activity, detect suspicious transactions, and report in accordance with FATF travel rules.

Government and Tax Authorities

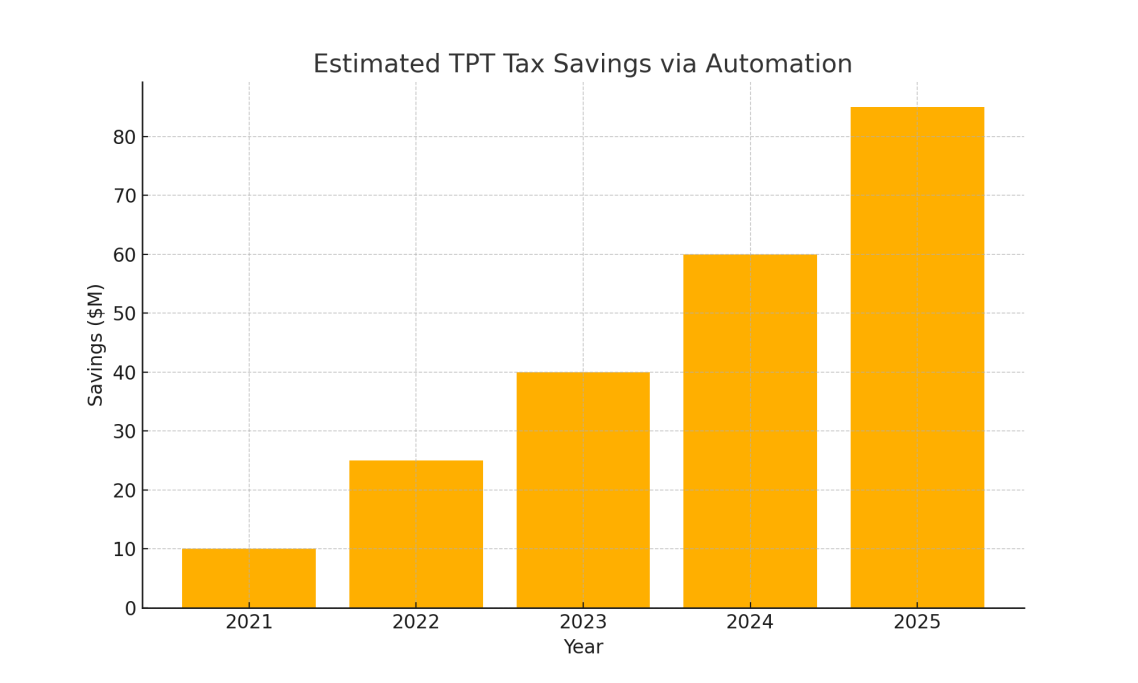

We support local and national governments with automation tools for licensing, business registration, and TPT compliance. Improve transparency and reduce audit risk using AI.

Private Individuals & Accredited Investors

Who We Serve:

- High-net-worth individuals.

- Family offices.

- Accredited investors.

- Early-stage entrepreneurs looking to protect, grow, and transfer wealth with confidence.

Industry Insights:

In today’s evolving financial climate, individuals face increasing pressure from tax transparency rules (FATCA, CRS), crypto asset disclosures, and the complexity of multi-jurisdictional income. We empower clients with tools and guidance for:

- Asset preservation and protection in volatile markets

- Structuring direct investments, private placements, and alternative assets

- Navigating IRS reporting for digital and offshore holdings

- Wealth transition planning across generations with regulatory alignment

Why Caesar Advisory Group:

We provide strategic clarity for investors in emerging sectors like Web3, fintech, and ESG ventures while aligning financial actions with long-term goals and compliance frameworks.

Companies (SMBs, Startups, & Corporations)

Who We Serve:

- Retail businesses.

- Fintech startups.

- Auto dealers.

- Health service providers.

- Growth-stage enterprises across diverse sectors.

Industry Insights:

Modern businesses must balance innovation with increasing scrutiny from regulators and payment processors. Key market forces shaping operations include:

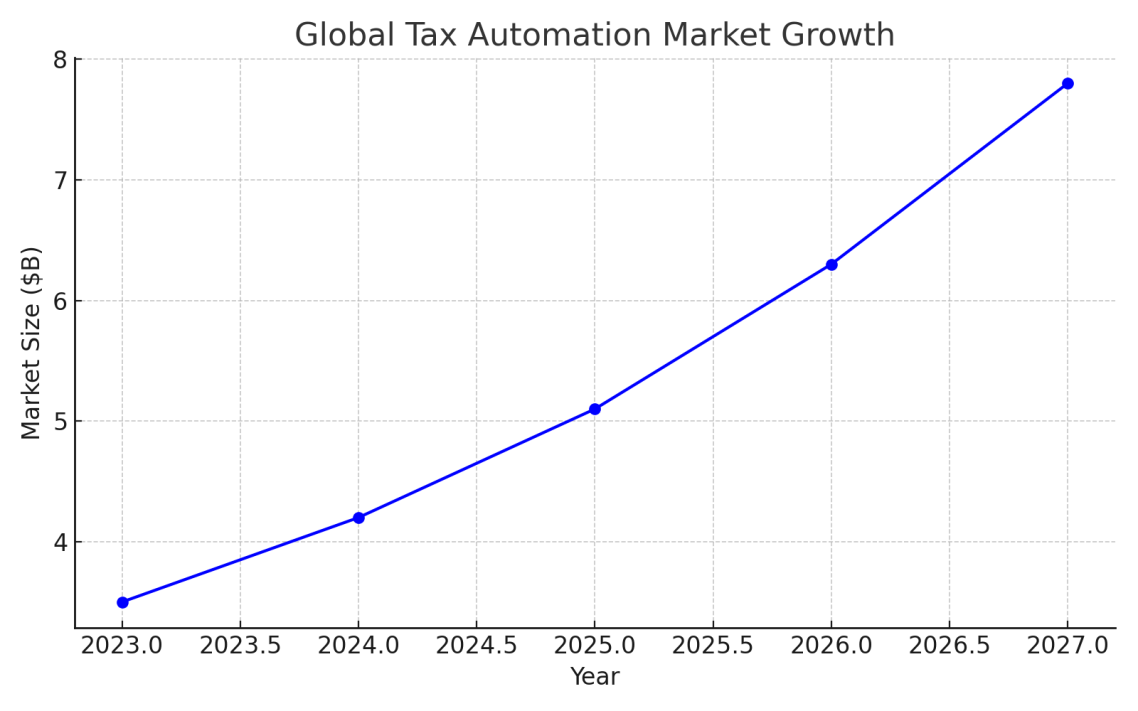

- Digital transformation accelerating tax obligations (e.g., Wayfair ruling implications)

- Vendor and customer due diligence requirements (KYC/AML)

- The need for scalable payment ecosystems that integrate traditional and crypto rails

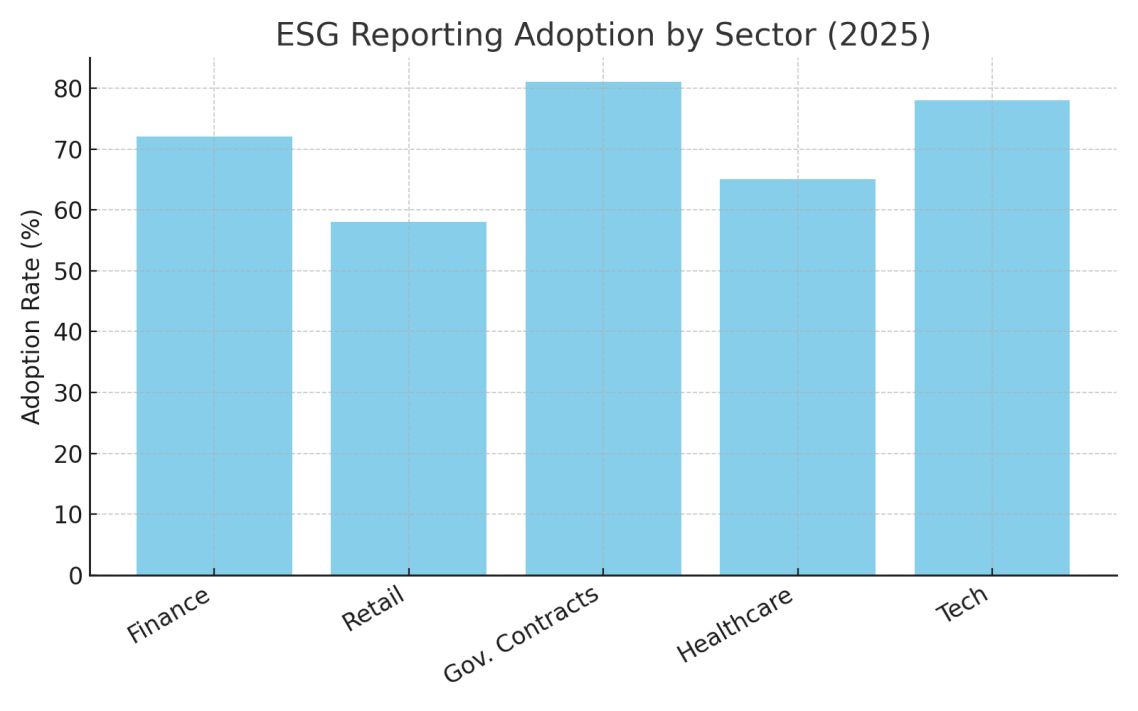

- Heightened ESG reporting expectations and DEI transparency pressures

Why Caesar Advisory Group:

We help businesses streamline compliance, reduce operational friction, and gain a competitive edge by preparing for audits, expanding across jurisdictions, and leveraging AI to improve reporting accuracy and risk visibility.

Public Sector, Government & Municipalities

Who We Serve:

Local governments, city tax agencies, infrastructure departments, and economic development authorities.

Industry Insights:

Governments today are tasked with doing more with less. With expanding mandates and shrinking margins, strategic modernization is key

- Tax remittance compliance is increasingly digitized and under federal and state oversight

- ESG and DEI mandates are now tied to federal funding eligibility

- Data-driven decision-making is critical for budget forecasting and grant performance

- Cybersecurity and privacy are integral to citizen trust

Why Caesar Advisory Group:

We provide tailored advisory and automation solutions that help public entities enhance transparency, simplify regulatory filings, and improve audit preparation—all while staying budget-conscious and people-focused.

Nonprofits & Foundations

Who We Serve:

- Charitable organizations.

- Research institutions.

- Religious entities.

- Philanthropic foundations.

- Donor-advised funds.

Industry Insights:

Nonprofits operate in a dual world: mission-first, but increasingly compliance-bound. The landscape is changing:

- Donor and grantor expectations around transparency and tax stewardship

- IRS scrutiny around 990 filings, fundraising disclosures, and unrelated business income (UBI)

- Challenges managing cross-border gifts and donor-advised fund compliance

- ESG alignment and impact tracking are critical for institutional donors

Why Caesar Advisory Group:

We empower mission-driven organizations to stay compliant while focusing on purpose. Our consulting enhances financial resilience, board oversight, and public trust—ensuring your story is one of both impact and integrity.

Here we can support you

In the fast-paced world, support is key to driving success and fostering innovation. Consultants provide valuable guidance, helping organizations navigate challenges and implement strategic solutions. By offering expertise in areas such as operational efficiency, market analysis, and project management, consultants empower businesses to optimize performance and achieve their goals. Whether through tailored advice or in-depth training programs, effective support is essential for leaders to make informed decisions and enhance their competitive edge.

Business Planning

Effective business planning, succession, and marketing strategies are crucial components of successful business management consulting. Businesses must develop comprehensive plans that outline their goals, target markets, and operational strategies to navigate the competitive landscape.

Asset accumulation

Consultants focus on identifying and optimizing both tangible and intangible assets, including physical property, intellectual property, and human capital. By implementing effective asset management strategies, businesses can drive profitability, improve operational efficiency, and foster innovation, ultimately positioning themselves for competitive advantage in the marketplace.

Asset management

Optimize resources and enhance overall performance: Identify growth opportunities and minimize risks through effective asset management that optimizes resources and enhances overall performance with compliance of global regulatory environments. Our strategies involve a thorough assessment of both tangible and intangible assets, ensuring that companies align their investments with their long-term objectives. utilizing advanced analytics and technology-driven tools that streamline asset tracking, improve decision-making, and ultimately drive sustainable profitability in a competitive market.

Retirement Solutions

Offering tailored retirement solutions to enhance talent retention, improve workforce morale, and position themselves as desirable employers in competitive markets. Our comprehensive retirement planning solutions comply with regulatory requirements and align with your business strategy.

Income Protection

We play a pivotal role in helping organizations identify and implement effective strategies to safeguard their revenue streams. By analyzing market trends, developing risk management frameworks, and optimizing operational efficiencies we can help organizations identify and implement effective strategies to safeguard their revenue streams develop, consulting experts can provide tailored solutions that protect against volatility.

Health care

By leveraging data analytics, optimizing resource allocation, and streamlining processes, consultants help healthcare organizations navigate the complexities of regulatory compliance and technological advancements. This collaboration not only drives innovation but also ensures that healthcare providers can focus on delivering high-quality services while maintaining financial sustainability. As the industry continues to face new challenges, strategic consulting remains an essential partner in fostering a robust and adaptive healthcare system.

2025-2027 Industry Outlooks and Insights

Banking

Risk Management

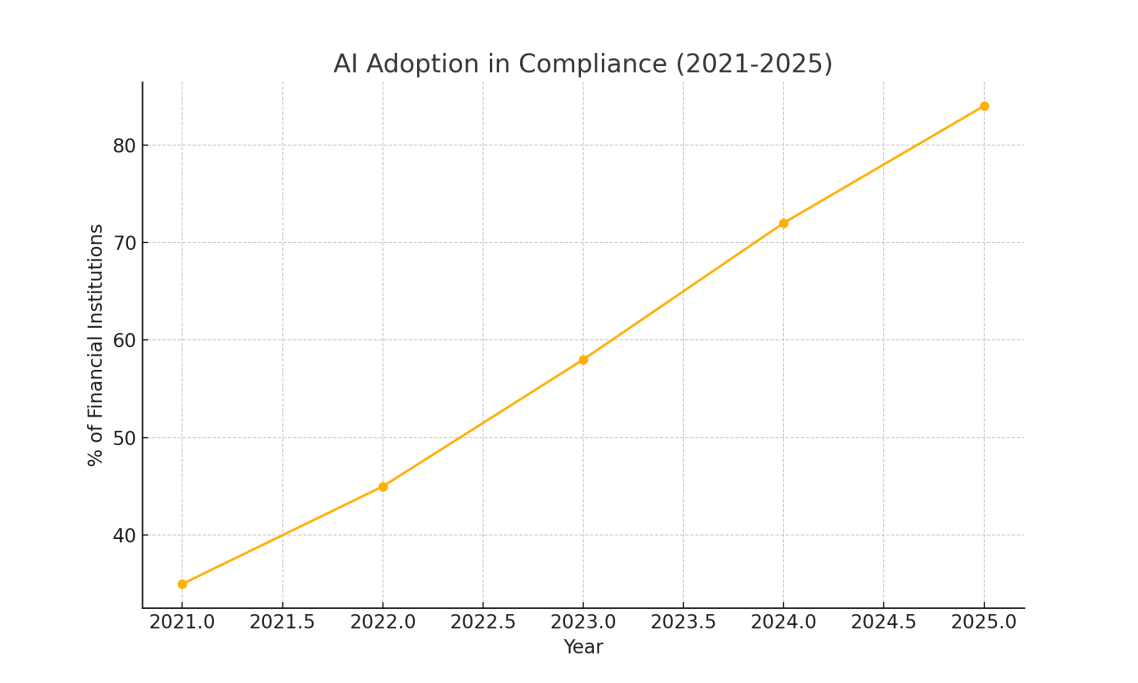

Tax and Compliance

Wealth Management: